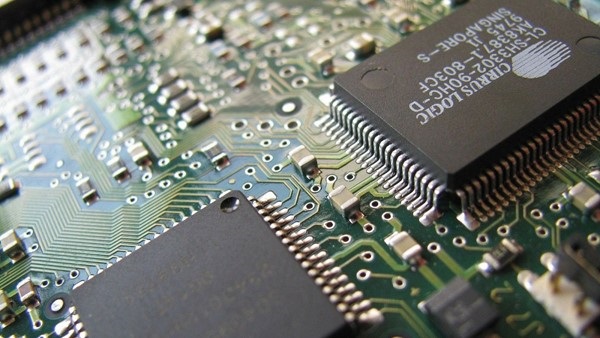

The World Relies on One Chip Maker in Taiwan, Leaving Everyone Vulnerable

Taiwan Semiconductor Manufacturing Co.’s dominance poses risks to the global economy, amid geopolitical tensions and a major chip shortage

The

company makes almost all of the world’s most sophisticated chips, and many of

the simpler ones, too. They’re in billions of products with built-in

electronics, including iPhones, personal computers and cars—all without any

obvious sign they came from TSMC, which does the manufacturing for better-known

companies that design them, like Apple Inc. and Qualcomm Inc. QCOM -1.74%

TSMC

has emerged over the past several years as the world’s most important

semiconductor company, with enormous influence over the global economy. With a

market cap of around $550 billion, it ranks as the world’s 11th most valuable

company.

Its

dominance leaves the world in a vulnerable position, however. As more

technologies require chips of mind-boggling complexity, more are coming from

this one company, on an island that’s a focal point of tensions between the

U.S. and China, which claims Taiwan as its own.

Analysts

say it will be difficult for other manufacturers to catch up in an industry

that requires hefty capital investments. And TSMC can’t make enough chips to

satisfy everyone—a fact that has become even clearer amid a global shortage,

adding to the chaos of supply bottlenecks, higher prices for consumers and

furloughed workers, especially in the auto industry.

The

situation is similar in some ways to the world’s past reliance on Middle

Eastern oil, with any instability on the island threatening to echo across

industries. Companies in Taiwan, including smaller makers, generated about 65%

of global revenues for outsourced chip manufacturing during the first quarter

of this year, according to Taiwan-based semiconductor research firm TrendForce.

TSMC generated 56% of the global revenues.

Being

dependent on Taiwanese chips “poses a threat to the global economy,” research

firm Capital Economics recently wrote.

TSMC,

which is listed on the New York Stock Exchange, reported $17.6 billion in

profits last year on revenues of about $45.5 billion.

Its

technology is so advanced, Capital Economics said, that it now makes around 92%

of the world’s most sophisticated chips, which have transistors that are less

than one-thousandth the width of a human hair. Samsung Electronics Co. makes

the rest. Most of the roughly 1.4 billion smartphone processors world-wide are

made by TSMC.

It

makes as much as 60% of the less-sophisticated microcontrollers that car makers

need as their vehicles become more automated, according to IHS Markit, a

consulting firm.

TSMC

said it believes its market share for those microcontrollers is about 35%.

Company spokeswoman Nina Kao refuted the idea that the world depends too much

on the company, given the many areas of specialization in the world’s

semiconductor supply chain.