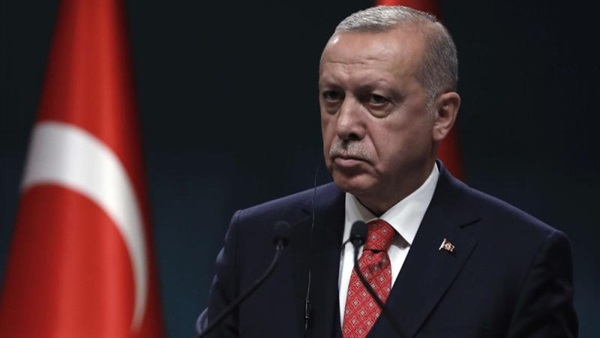

Turkey is heading for economic collapse, Ashmore says

Turkish President Recep Tayyip Erdogan risks pushing

Turkey’s economy into an economic collapse similar to those seen in Latin

America under populist regimes, Bloomberg reported on Wednesday, quoting

Ashmore Group Plc.

While more diversified than Venezuela’s

oil-dependent economy, Turkey is currently on a very similar path of policy

missteps that are likely to lead to ruin, the $85 billion emerging-market asset

manager said.

Capital controls, nationalization and other policies

designed to prevent the private sector from protecting its property as the

macroeconomic environment deteriorates are the next “logical policy steps” that

will follow in Turkey, Jan Dehn, the London-based head of research at Ashmore,

said by email.

His comments, initially in a research report

Tuesday, came after Erdogan rattled markets by dismissing central-bank Governor

Murat Cetinkaya early Saturday.

“The problem is that U-turning back to good policies

has very big upfront political costs,” said Dehn, who caught the bottom of the

market on the Russian ruble in December 2014 and turned bullish on emerging

markets in October 2015, months before a two-year rally began. “The longer he

delays the bigger the cost, which is why politicians who go down the heterodox

route rarely change tack and they almost always end in crisis.”

Turkish officials have repeatedly denied any plans

to impose capital controls and said they would adhere to free-market

principles.

Dehn expounded the causes of the decline saying that

"bad economic policies begin to extract a political cost

Instead of fixing the causes of the underlying

economic problem, the government decides to attack the symptoms of the problem,

such as inflation, slower growth, weaker currency and slowing investment. The

real problems meanwhile are ignored and get worse. They include bad monetary

policies, increasing interventionism, failure to develop local financing

markets, overly low savings rates and bad foreign policies."

The government also blames other groups instead of

itself, because this works politically, but it only makes investors and

businesses even more worried as Erdogan will need more and more scapegoats as

the economy worsens.

As the economic outlook worsens, investors and

businesses begin to take action to defend their wealth and livelihoods. This

results in capital flight, declining investment and other hedging strategies.

The government starts to blame the private sector

for bad performance, taking action to prevent their defensive actions. Enter

capital controls, nationalization, forced conversion of contracts.

Eventually, the government has no financing, no

growth, no future and plunges into a crisis.