Qataris forgetting Turkish colonialism as Western interests threatened

Few Qataris who fought the Ottoman colonialists to

gain their independence in 1915 and end the 44-year-long Turkish rule in the

peninsula would ever have imagined that their grandchildren would become

Turkey's closest strategic allies.

Qatar, a tiny but extremely wealthy sheikdom, has a

constitution based on sharia (Islamic religious law), while Turkey's constitution

is strictly secular (officially, if not in practice). In Qatar, flogging and

stoning—unthinkable in Turkey—are legal forms of punishment. In Qatar, apostasy

is a crime punishable by death, while in Turkey it is not a criminal offense.

But the ideological kinship between the two Sunni

Muslim countries, which is based on passionate political support for Hamas and

the Muslim Brotherhood (and a religious hatred of Israel), seems to have

produced a bond that threatens Western interests.

In 2014 Turkey and Qatar signed a strategic security

agreement that gave Ankara a military base in the Gulf state, which is already

home to the largest US air base in the Middle East (al-Udeid). Turkey stationed

some 3,000 ground troops at its Qatari base in addition to air and naval units,

military trainers, and special operations forces.

In 2017, in a Sunni vs. Sunni drama in the Gulf, a

Saudi-led coalition imposed a blockade on Qatar accusing it of supporting

terrorism and fostering ties with the rival Shiite force, Iran. Turkey

immediately rushed to Qatar's aid, sending cargo ships and hundreds of planes

loaded with food and essential supplies to break the blockade. Ankara also

deployed more troops at its military base in Qatar in a gesture suggesting that

it would assist in protecting the country militarily.

2018 was payback time for the sheikdom. Doha pledged

$15 billion in investment in Turkish banks and financial markets when Turkey's

national currency lost 40% of its value against major Western currencies in the

face of US sanctions. In other words, one US ally in the Middle East was

financially helping another US ally evade US sanctions.

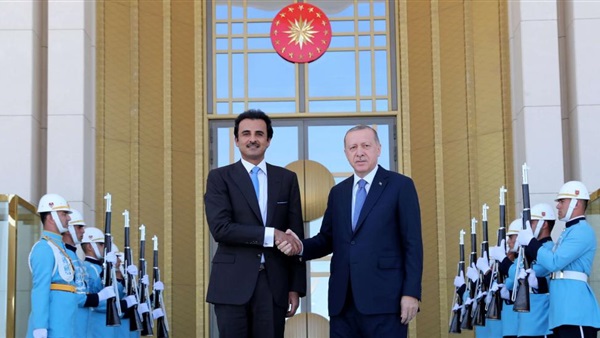

The Qatari favor to the Turkish nation was followed

by a massive gift to its leader when Qatar's emir, Tamim bin-Hamad al-Thani,

gave Turkish president Recep Tayyip Erdoğan

a Boeing 747-8 aircraft, the world's largest and most expensive private jet,

priced at around $400 million.

The Turkish-Qatari love affair had its tender

moments in defense industry cooperation too. A Qatari investment fund bought a

49% stake in BMC, a Turkish armored vehicles manufacturer, whose Turkish

partners are notorious Erdoğan cronies. In a

bidding result that surprised no one, BMC won the serial production contract

for the Altay, the indigenous, next-generation Turkish main battle tank in the

making. Under the multi-billion-dollar deal, BMC will eventually produce more

than 1,000 Altays. (In a controversial move, Erdoğan's

government also allocated a military-run tank facility to BMC.) In one of

several defense industry deals, Havelsan, a state-controlled military software

company in Ankara, signed a partnership agreement with Al Mesned Holdings in

Qatar for a joint venture that will specialize in cyber-security solutions for

the sheikdom.

So far so good. But Turkey's fundamental economic

imbalances persist and are likely to worsen in the post-pandemic era. The

unemployment rate, officially 13.6% in February, is forecast to reach 17.2% by

the end of the year. The national currency has depreciated as sharply as it did

during the 2018 crisis: One US dollar was traded at 7.26 Turkish liras in

mid-May 2020 versus 3 liras in September 2016. Following a 20% rise within a

year, Turkey's gross foreign currency liabilities have reached $300 billion

(net foreign liabilities are at $175 billion). Mismanagement and palliative

efforts to keep the lira afloat has caused the Turkish Central Bank to burn

through $65 billion in reserves since January 2019.

In order to stop the lira's slide and provide

Turkish banks with the foreign liquidity they need, the Central Bank has been

desperately but unsuccessfully seeking currency swap agreements* with the

world's major economies, including with the Federal Reserve Bank, the Bank of

Japan, and the Bank of England.

All this financial misfortune comes at a time when

the Turkish economy is poised to deteriorate further due to potential US

sanctions. Washington has warned of sanctioning Turkey as part of the

Countering Adversaries of America Through Sanctions Act (CAATSA) for having

acquired the Russian-made S-400 long-range air and anti-missile defense system.

The sanctions will go into effect if Ankara activates the Russian system.

Additionally, a US court has threatened to sanction, at the magnitude of

billions of dollars, a Turkish government lender, Halkbank, for evading US

sanctions on Iran. If those sanctions go into effect, Turkey's economic

troubles could turn into an existential financial/political crisis that would

threaten Erdoğan.

Erdoğan knew where to

turn for help. On May 20 the Turkish Central Bank announced that it had tripled

its currency swap agreement with Qatar,* meaning it had secured much-needed

foreign currency funding. The deal raised the 2018 swap agreement's $5 billion

limit to $15 billion and immediately boosted the lira.

Once again, US ally Qatar has rushed to offer

financial aid to US ally Turkey to help it withstand US sanctions. Just as it

did in 2018, Qatar has at least partially thwarted US sanctions.